European banks continue to be well positioned from a solvency perspective to support households and businesses during this period of abnormal economic stress.

Having entered the Covid-19 crisis with the highest solvency ratios on record, European banks have further increased their capital buffers during 2020 reaching a new record high in core CET1 capital in 3Q 2020 through a combination of profit generation, regulatory support, and balance sheet adjustments.

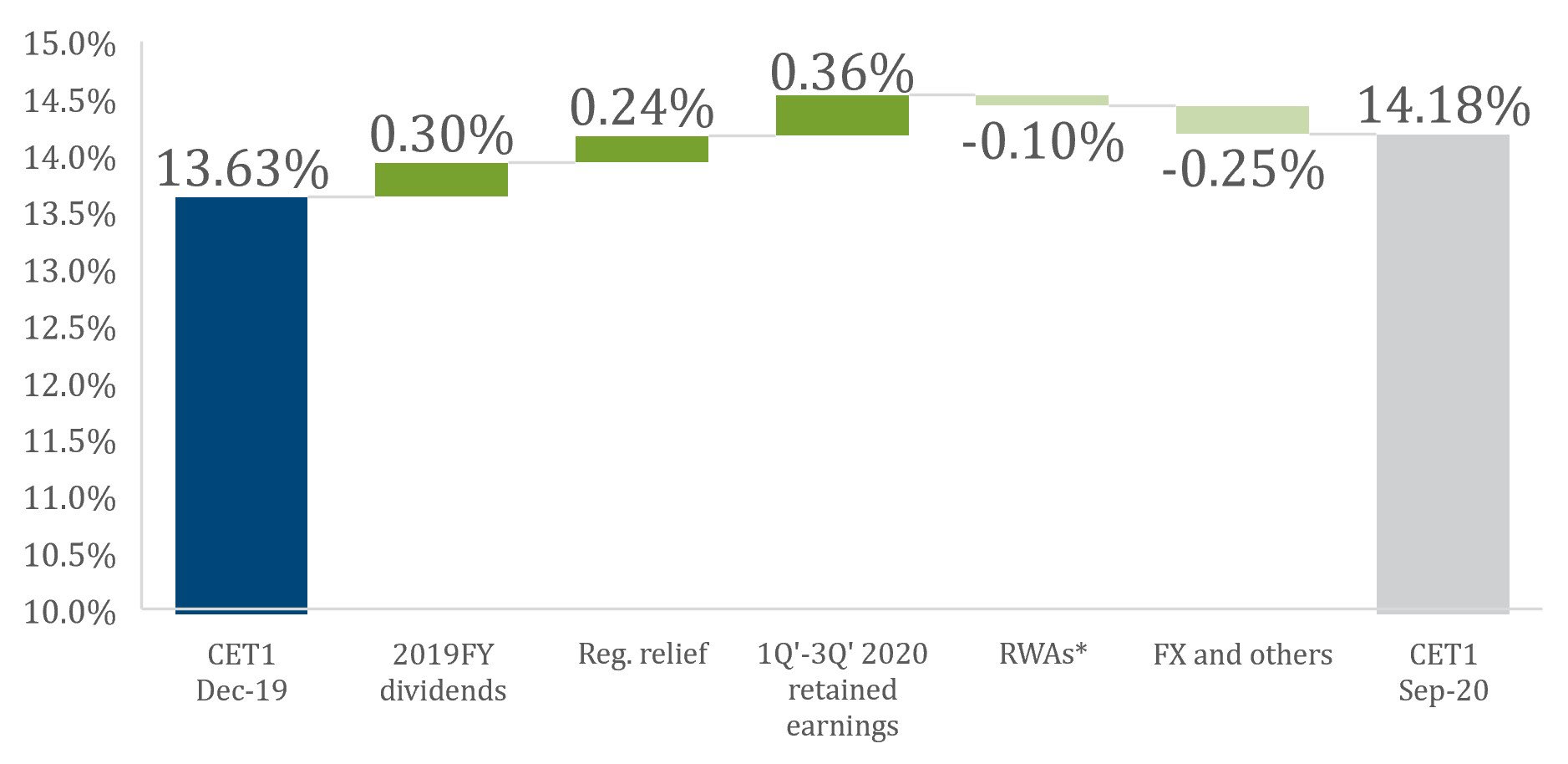

European Global Systemically Important Banks (GSIBs) core capital ratios (CET1 ratio) were 14.18% in 3Q 2020 on a weighted average basis, 55bps above the level reported at the end of 2019 and 418bps above the ratio observed in 2013.

Some of the main drivers of the record high in core capital ratios are discussed in this blog.

Ban on 2019FY dividend distribution: +30bps on CET1

The ECB and the BoE’s PRA recommended that Euro Area and UK banks suspend their planned 2019 dividend distributions in order to preserve capital and support lending to their customers, thereby helping to cushion the negative economic impact form the Covid-19.

According to AFME estimates based on European GSIBs’ public disclosures, compliance with the regulatory request of withholding 2019FY dividend distribution contributed 30bps to banks’ CET1 ratio as at 3Q 2020.

Although the dividend ban, which remains in place, has moderately helped to improve banks’ capital ratios, the benefits have come with associated costs.

The ban on dividends was implemented across the board and although this avoided potential stigma from some banks being forced to suspend dividends while others were excused from doing so, it did prevent banks with large buffers above their Maximum Distributable Amount (MDA) thresholds from making distributions which they could well afford.

Banning dividend payments also disrupted the flow of income to bank investors, life companies, pension funds and retail investors. As such they risked negatively impacting on consumption and further penalising certain parties that are already suffering from the consequences of a crisis that is not of their making.

Moreover, withholding dividend payments has significantly depressed bank share prices, increasing their potential cost of equity and inhibiting their ability to use their paper to undertake any corporate activity. It has further disturbed the established relationship with regulators and the processes by which distributions were previously agreed. The intervention may therefore lead to more lasting damage given the precedent created which may result in bank investors imposing an “uncertainty discount” on share ratings to reflect the risk of future unexpected regulatory interventions.

Regulatory relief: +24bps on CET1

Recognising the scale of the pandemic, on 28 April, the European Commission proposed targeted changes to the Capital Requirements Regulation (CRR) to maximise the capacity of banks to lend and to absorb losses related to the pandemic.

The package mitigates the capital impacts of IFRS9 expected loss accounting and contribute to banks’ capacity to continue to support the economy during the pandemic and through recovery. The measure also included the advanced application of SME and infrastructure supporting factors to facilitate lending to those sectors.

The regulatory relief complemented other supervisory guidance that banks should draw down their capital buffers.

These regulatory relief measures have contributed to improve banks CET1 ratios by 24bps as at 3Q of 2020 according to AFME estimates based on European GSIBs public disclosures.

Earnings retention: +36bps on CET1

Banks have continued to generate internal capital through profit retention, accumulating a total of 36bps on CET1 according to AFME estimates.

Most recently, some banks have provided investor guidance by pre-announcing the expected amount of 2021 dividends to be distributed (subject to regulatory approval). The 2021 dividend distribution has been excluded from the contribution of retained profits on CET1.

Any future dividend distribution is subject to supervisory approval as the current dividend ban has been recommended by the ECB until 1 January 2021, although the policy measure will be reviewed in December 2020. Any decision on the resumption of dividends is likely to take account of a number of factors but in particular the visibility that banks have of their future capital needs in the context of their prospective levels of non-performing loans.

RWAs variation: -10bps on CET1

Most banks have reported an increase in RWAs during the year, predominantly due to the record increase in loan origination and from a rapid growth in market risk RWAs. Market risk RWAs have risen due to the significant increase in market volatility and trading activities during the year.

The reallocation of business capacity to support companies during the pandemic has resulted in a negative contribution of 10bps on CET1 ratio. This impact excludes the regulatory support measures which, particularly the introduction of the SME and infrastructure support factors, reduced the risk weights on loan origination for those sectors.

Change in CET1 ratio by components in 2020 (1Q-3Q) (%)

Source: AFME with data from European GSIBs earnings reports. *RWAs excludes impact of regulatory relief on RWAs.

While the full effects of the Covid-19 induced economic downturn are still somewhat uncertain, banks remain very strongly capitalised and willing and able to support all viable customers while at the same time absorbing an inevitable increase in non-performing loans. As we move into 2021, they should be allowed to resume cautious distributions in support of their shareholders.