The settlement efficiency rate – or the proportion of transactions which are completed on their contractually agreed settlement date – has become a topic of intense scrutiny for regulators and market participants in the European securities post-trade industry. The current default settlement period for most transactions stands at two days, or “T+2”. Measuring settlement efficiency is critical to answering other important post-trade-related questions that policymakers are currently weighing up. For example, whether changes to the Central Securities Depository Regulation (CSDR) Settlement Discipline rules are required. ESMA has recently consulted on potential changes to the cash penalties charged for settlement fails, including proposals to significantly increase the daily rate. Although mandatory buy-in proposals are currently off the table, they will only remain so if regulators are satisfied that levels of settlement fails do not pose any financial stability risk.

Settlement efficiency is also closely intertwined with the current T+1 debate. It will be important to understand whether moving to T+1 will reduce settlement efficiency, and if so, by how much. A substantial increase in fails would mean the risk reduction benefits of T+1 are not fully realised.

The question, however, arises as to whether settlement efficiency is being measured correctly. Different methodologies can produce different results, which could have a significant impact on informing policy decisions taken by public authorities.

There are several dimensions to consider:

-

Firstly, should settlement efficiency be measured by volume (i.e. based on the number of instructions that fail to settle) or value (i.e. based on the market value of the failing instructions)? In other words, should more importance be attached to one fail worth 100mn EUR, or ten fails each worth 1,000 EUR? If we are primarily thinking about the systemic risk impact, it seems intuitive to focus on value.

-

Secondly, what type of activity should be included when assessing risk? Numerous instructions processed by CSDs do not necessarily relate to a “trade”. For example, collateral transfers, portfolio realignments, corporate actions, and other types of CSD-generated movements. Are these other types of settlements as important or relevant when assessing levels of risk?

-

Another interesting question centres on how a multi-day settlement fail should be recorded. Should it be counted only once, on the first business day that the instruction fails or rather recounted as a fail on each business day that it misses settlement?

Historically, there was no consistent, pan-European approach to these types of question. ESMA collected data from CSDs on a ‘best efforts’ basis and tried to make sense of it for inclusion in their biannual “Trends, Risks and Vulnerabilities” (TRV) report.

The application of CSDR Settlement Discipline measures in February 2022 included a requirement for CSDs to provide regular settlement fails data to their relevant National Competent Authority (NCA) (and onwards to ESMA) in a standardised format. This requires CSDs to break down fails according to different criteria, such as the type of financial instrument, the type of transaction, whether it was intra-CSD or cross-CSD, and whether the fail resulted from a failure by the seller to deliver the securities or the buyer to deliver the cash.

What does the data show?

The most recent TRV report, published in February 2024, is the first to utilise the new standardised CSDR methodology. The benefit of establishing a common approach is the publicly available and consistent data that covers all CSDs in the EEA under the same methodology.

However, this only provides consistent data from February 2022 to the present. ESMA’s data from pre-CSDR cash penalties uses a different methodology than from post-CSDR cash penalties. This makes it very difficult to assess the effectiveness of CSDR cash penalties and, consequently, to draw any conclusions about further policy developments.

Nonetheless, there are clear positive signs:

-

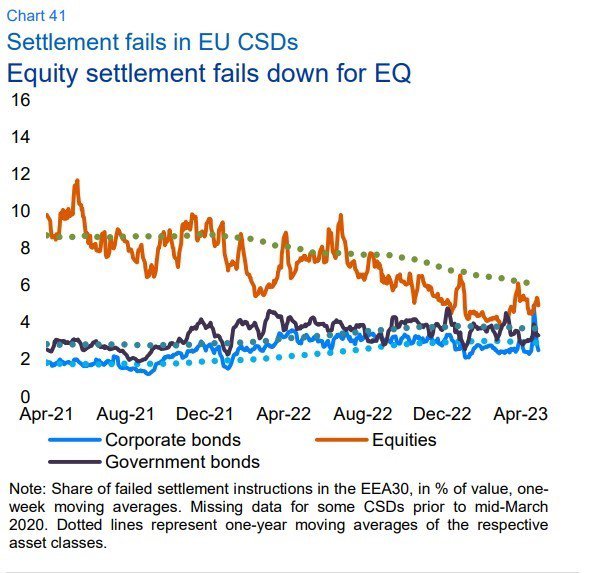

Figure 1 shows an extract from the last TRV report and uses the ‘old’ methodology, revealing a clear downward trend in equity settlement fails between April 2021 and April 2023, and a broadly flat trend in fixed income. This largely aligns with anecdotal feedback from market participants, who made efforts to improve settlement processes and reduce fails in anticipation of the introduction of CSDR penalties.

-

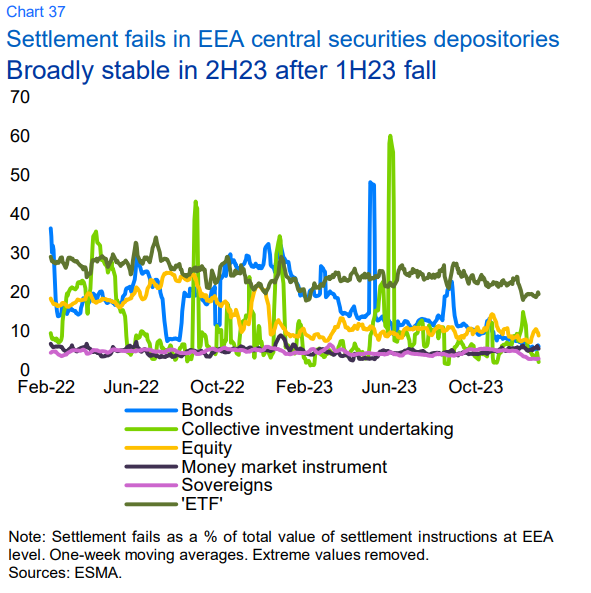

Figure 2 showcases the first TRV report using the ‘new’ methodology. The data paints a less definitive picture, showing more volatile fail rates in asset classes such as bonds and ETFs. The new report no longer includes the one-year moving average, but it does show that for every single asset class measured, the settlement fail rate at the end of 2023 was lower than the settlement fail rate in February 2022.

So, under both the ‘old’ and ‘new’ ways of measuring fails, ESMA’s own data appears to suggest that the introduction of CSDR cash penalties has coincided with a definitive reduction in settlement fails. This is great news for regulators, and great news for the industry.

Figure 1: ESMA TRV 2-2023

Figure 2: ESMA TRV 1-2024

How should we interpret it?

As the charts demonstrate, the old and new methodologies appear to produce quite different results. Figure 1 estimates equity fail rates between 5%-10% through the course of 2022 yet figure 2 shows equity fail rates for the same time period reaching as high as 20%. Without knowing the “pre-CSDR” methodology used by each CSD, it is difficult to determine exactly what is causing the difference. Further insight may be found in the annual report that CSDs are mandated to publish. This is, in effect, a more basic version of the data they provide to ESMA and does not contain the same granularity on asset class or transaction type, and therefore presents an incomplete picture.

Importantly, it should be noted that the CSD’s individual data can be highly susceptible to being skewed by a small number of large failing instructions. For example, Euroclear Bank reported a fail rate of 9.52% for 2023, down from 14.46% in 2022. They note that by removing from their calculation a handful of fails on instructions, “related to securities that are issued in units but where the participant erroneously instructs in nominal”, the fail rate drops to 6.27%. The impact of these misbookings is even more egregious in Clearstream Luxembourg’s figures – in 2022, their fail rate was reported as 58.76%!

The industry’s efforts to reduce settlement fails are highly reliant on good quality, accurate, complete and timely public information. This is critical to identifying particular problem areas – be that asset class, settlement location, type of transaction – that should be focused on. Unfortunately, the public information disclosed by CSDs has so far proved somewhat unreliable.

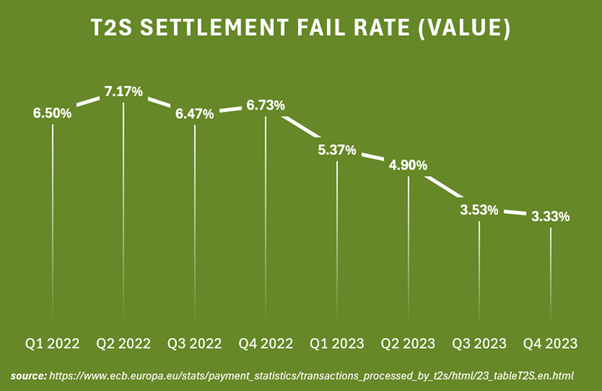

T2S – a common settlement platform to which 24 European CSDs are connected – also publish data on settlement fails. Again, this provides an incomplete picture, as not all CSDs are connected to T2S, but provides a reliable and consistent methodology that can be tracked over time. T2S data demonstrates a clear downward trend in settlement fails since the introduction of CSDR cash penalties in Q1 2022. Fail rates, measured in value, were 49% lower in Q4 2023 than in Q1 2022.

The question of whether settlement efficiency is improving, can by almost any measure be answered with an emphatic yes. The more pertinent question to ask is, “is settlement efficiency improving enough?”. That question can only be answered by public authorities. ESMA have recently consulted on whether changes are required to the current penalty mechanism, including a potential increase to the daily penalty rates that are applied in order to drive a reduction in fails.

No explicit target for an ‘acceptable’ level of settlement fails has ever been set. However, the general view from AFME members is that levels of settlement fails in the EU have as much as halved since the start of 2022 and are broadly comparable with other jurisdictions including the US. On that basis, AFME considers that the application of CSDR cash penalties should be considered a success and does not believe that there is a case for a radical overhaul of the existing regime.