AFME is pleased to circulate its Equity Primary Markets and Trading Report for the third quarter of 2019 (3Q 2019).

The report provides an update on the performance of the equity market in Europe in areas such as primary issuance, Mergers and Acquisitions (M&A), trading, and equity valuations.

Key highlights:

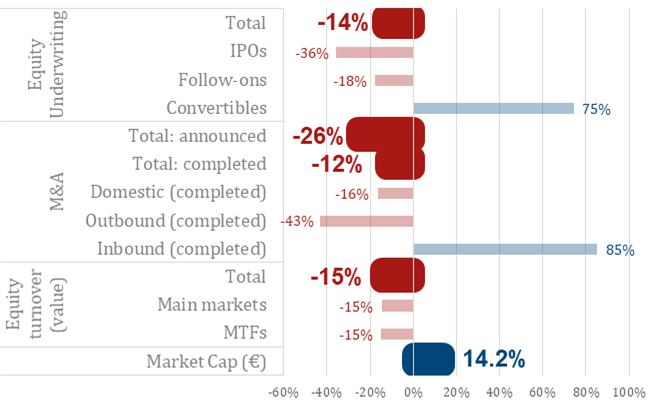

- Equity underwriting on European exchanges accumulated a total of €86.3 bn in proceeds in the first three quarters of 2019, a 14% decrease from the value originated in the same period of 2018 (€100.2 bn).

IPO issuance in 2019YtD decreased 36% against the amount issued in the first three quarters of 2018. IPOs on Junior markets totalled €0.9 bn in proceeds in 2019YtD, the lowest YtD amount since 2013

103 IPOs have been issued on European exchanges during the first three quarters of 2019—the lowest YtD number since 2013 (102).

- Completed Mergers and Acquisitions (M&A) of European companies totalled €693 bn in 2019YtD, a decrease of 12% from 2018YtD (€790.5 bn), driven by a 43% decline in Outbound M&A (i.e. acquisition of non-European firms by European firms)

The amount of announced M&A deals totalled €676.4 bn in 2019YtD, a 26% decrease from 2018YtD.

Private Equity-backed M&A activity (“Sponsor” deals) totalled €43bn in 3Q 2019— a decline of 36% YoY and also the lowest quarterly amount since 2014 Q2.

- Equity trading activity on European main markets and MTFs generated a total of €7.0 tnin turnover value in 2019YtD, a decrease of 15% from 2018YtD (€8.3tn)

- Update on MiFID II dark trading caps:

The Double Volume Cap (DVC) mechanism seeks to limit the total dark trading of equity-like instruments on EU venues

ESMA publishes on a monthly basis the list of instruments temporarily banned from dark trading at the EU or trading venue level after surpassing pre-determined dark trading thresholds

The number of instruments banned from dark trading has decreased since the DVC mechanism was launched, from 755 in March 2018 and from 1,262 in August 2018 to 376 in October 2019 (c1% of the Universe of 27,649 equity and equity-like instruments).

2019 YtD variation of European Equity activity

EU28 member countries and Switzerland