Key highlights:

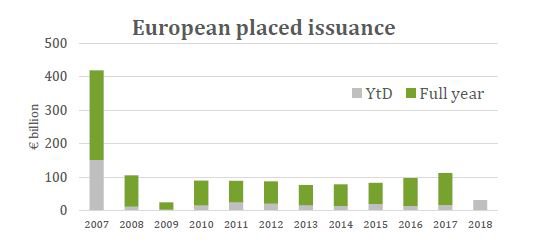

- In Q1 2018, EUR 57.4 bn of securitised product was issued in Europe, a decrease of 21.5% from Q4 2017 (EUR 73.1 bn) and an increase of 44.2% from Q1 2017 (EUR 39.8 bn)

- Of this, EUR 31.5 bn was placed, representing 54.9% of the total, compared to EUR 31.6 bn placed in Q4 2017 (representing 43.2% of EUR 73.1 bn) and EUR 17.3 bn placed in Q1 2017 (representing 43.5% of EUR 39.8 bn)

- In Q1 2018, PanEuropean collateralised loan obligations (CLOs) led placed totals followed by UK residential mortgage-backed securities (RMBS) and Dutch RMBS

- PanEurope CLO decreased from EUR 13.6 bn in Q4 2017 to EUR 11.7 bn in Q1 2018. According to Thomson Reuters LPC, the combined amount of European CLO resets and refinancings totalled EUR 4.3 bn in Q1 2018 (from EUR 4.8 bn in Q4 2017).

- UK RMBS increased from EUR 2.2 bn in Q4 2017 to EUR 5.6 bn in Q1 2018.

- Dutch RMBS increased from no issuance in Q4 2017 to EUR 3.9 bn in Q1 2018.