This report provides a comprehensive data source with updated statistics of the Government bond primary and secondary markets in Europe (EU28).

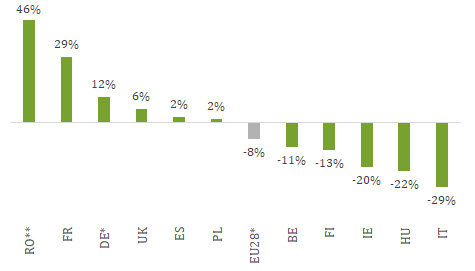

- Average daily trading volumes of European government bonds decreased in the majority of jurisdictions between 2Q17 to 3Q17, and fell 24% on aggregate. The year on year (YoY) decline in turnover was 7.6%; however, there was an annual increase for four of the larger EU countries - France, Germany, UK, and Spain.

- The quarterly variation in the European government bond turnover volume since 3Q16 is strongly correlated with a European Policy Uncertainty Index, thus indicating that political uncertainty has been an important factor in the recent changes in trading volumes.

- The average years to maturity of outstanding government bonds in EU countries is highest in the UK and Ireland, whereas Eastern European countries tend to have much shorter average maturities.

- Since the start of 2012, Debt Management Offices have tended to auction bonds with a smaller notional amount, on a slightly more regular basis.

- The year so far has seen 11 long-term credit rating upgrades for EU countries compared to 2 downgrades, continuing the trend of increasing credit ratings for Southern and Eastern European countries.

Annual change in Government Bond average trading volumes

(2Q17 vs 2Q16) Selected European jurisdictions