AFME is pleased to circulate the European Securitisation Data Snapshot for Q4 2022 and 2022 Full Year.

Key highlights:

Q4 2022 European Issuance

- In Q4 2022, EUR 65.5 bn of securitised product was issued in Europe, an increase of 66.4% from Q3 2022 (EUR 39.4 bn) and a decrease of 34.7% from Q4 2021 (EUR 100.2 bn).

- Of this, EUR 11.6 bn was placed, representing 17.7% of the total, compared to EUR 19.0 bn placed in Q3 2022 (representing 48.2% of EUR 39.4 bn) and EUR 46.8 bn placed in Q4 2021 (representing 46.7% of EUR 100.2 bn).

- In Q4 2022, Pan-European CLOs led placed totals, followed by UK RMBS and German Auto ABS:

- Pan-European CLOs decreased from EUR 6.4 bn in Q3 2022 to EUR 6.1 bn in Q4 2022;

- UK RMBS decreased from EUR 5.1 bn in Q3 2022 to EUR 1.7 bn in Q4 2022; and

- German Auto ABS decreased from EUR 1.9 bn in Q3 2022 to EUR 0.9 bn in Q4 2022.

2022 Full Year European Issuance

- In 2022, EUR 203.3 bn of securitised product was issued in Europe, a decrease of 12.8% from the EUR 233.1 issued in 2021.

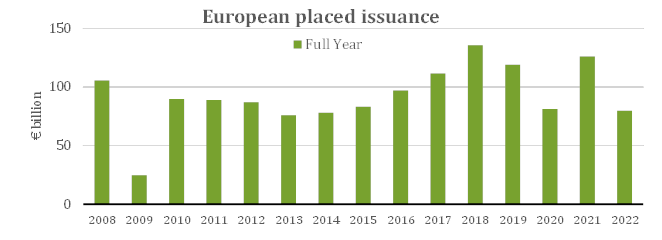

- Of this, EUR 79.7 bn was placed, representing 39.2% of the total, compared to EUR 126.0 placed in 2021 representing 54.1% of the total.

- In 2022, Pan-European CLOs led placed totals (EUR 26.1 bn) followed by UK RMBS (EUR 24.0 bn) and German Auto ABS (EUR 5.9 bn).

- As per the graph below, European placed securitisation issuance in 2022 was the lowest since 2014.