Q3 2022 European Issuance

- In Q3 2022, EUR 38.8 bn of securitised product was issued in Europe,1 an increase of 12.4% from Q2 2022 (EUR 34.5 bn) and a decrease of 18.4% from Q3 2021 (EUR 47.6 bn).2

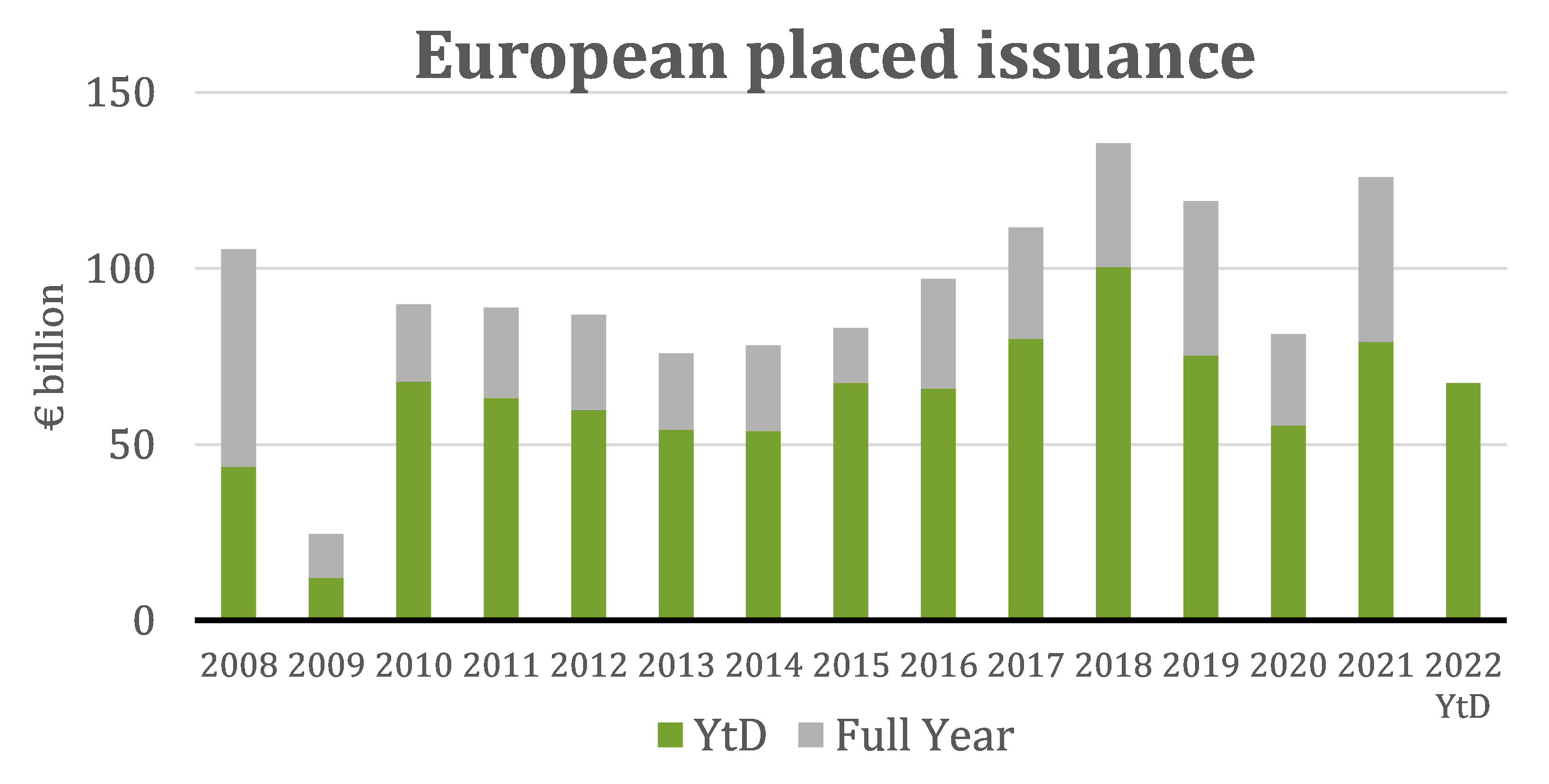

- Of this, EUR 18.5 bn was placed, representing 47.5% of the total, compared to EUR 16.4 bn placed in Q2 2022 (representing 47.4% of EUR 34.5 bn) and EUR 23.1 bn placed in Q3 2021 (representing 48.5% of EUR 47.6 bn).

- In Q3 2022, Pan-European CLOs led placed totals, followed by UK RMBS and German Auto ABS:3

- Pan-European CLOs increased from EUR 4.0 bn in Q2 2022 to EUR 6.4 bn in Q3 2022;

- UK RMBS increased from EUR 3.1 bn in Q2 2022 to EUR 5.1 bn in Q3 2022; and

- German Auto ABS increased from EUR 1.5 bn in Q2 2022 to EUR 1.9 bn in Q3 2022.

Sources: Bloomberg, Citigroup, Dealogic, Deutsche Bank, JP Morgan, Bank of America, NatWest Markets, Thomson Reuters, UniCredit, AFME & SIFMA.

Notes: (1) European volumes prior to 2020 include transactions from all countries in the European continent, including Russia, Iceland, Turkey and Kazakhstan, whereafter. European volumes include CLOs and CDOs denominated in all European currencies. (2) Volumes have been subject to periodical revision according to the available updated information. (3) For Q1-Q3 2022, European issuance volumes (ex-placed CLOs) are sourced from JP Morgan, with placed CLO issuance volume data sourced from Bank of America. (4) Due to ongoing revisions to the data, US non-agency issuance volumes have been revised upwards for 2019-2021. Most recent quarterly issuance data volumes (22Q2-22Q3) concerning the US non-agency RMBS, CMBS and CDO categories likely to be revised upwards in coming quarters.

Disclaimer: The AFME Securitisation Data Snapshot (the "Data Snapshot”) is intended for general information only, and is not intended to be and should not be relied upon as being legal, financial, investment, tax, regulatory, business or other professional advice. Neither AFME nor SIFMA represents or warrants that it is accurate, suitable or complete and neither of AFME nor SIFMA or their respective employees or consultants shall have any liability arising from, or relating to, the use of this Data Snapshot or its contents. Your receipt of the Data Snapshot is subject to paragraphs 3, 4, 5, 9, 10, 11 and 13 of the Terms of Use which are applicable to AFME’s website (available at https://www.afme.eu/About-Us/Terms-of-use) and, for the purposes of such Terms of Use, the Data Snapshot shall be considered a “Material” (regardless of whether you have received or accessed it via AFME’s website or otherwise).