Key highlights:

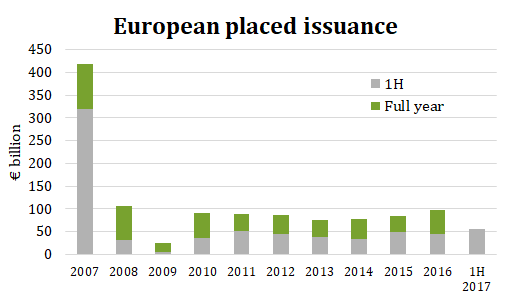

- In Q2 2017, EUR 71.6 billion of securitised product was issued in Europe, an increase of 91% from Q1 2017 (EUR 37.4 bn) and a decrease of 5% from Q2 2016 (EUR 75.3 bn).

- Of this, EUR 38.7 bn was placed, representing 54% of the total, compared to EUR 16.5 bn placed in Q1 2017 (representing 44% of 37.4 EUR bn) and EUR 29.6 bn placed in Q2 2016 (representing 39% of 75.3 EUR bn).

- In Q2 2017, UK RMBS led placed totals followed by Pan European CLOs and German Auto ABS:

- UK RMBS increased from 2.5 EUR bn in Q1 2017 to 17.3 EUR bn in Q2 2017. This included one exceptionally large transaction, Ripon Mortgages plc, at 11.9 EUR bn (of which 11.0 EUR bn was placed);

- Pan European CLOs increased from 5.8 EUR bn in Q1 2017 to 13.2 EUR bn in Q2 2017;

- German Auto ABS increased from no placed issuance in Q1 2017 to 2.7 EUR bn in Q2 2017.