The economic shock generated by the Covid-19 pandemic has amplified the need for deep and well-integrated capital markets in the EU in virtually every area. As Europe faces its deepest ever economic recession, it is clear that a robust post-pandemic recovery and sustainable long-term growth cannot be funded solely through government support programmes and the provision of bank loans. Strong capital markets are needed to channel the EU’s significant savings pools and private investment resources to where they are most needed.

The implications of Brexit, meanwhile, remain a key driving force behind the Capital Markets Union (CMU) project. The way EU businesses and market participants interact with the City of London – Europe’s deepest financial centre and wholesale markets hub – is set to be reshaped at the end of the Brexit transition period, even if optimistic scenarios for equivalence determinations and the future relationship materialise.

The question facing CMU is therefore not if it is needed, but whether policymakers will now seize the opportunity to generate the momentum to undertake the reforms needed to fulfil the objectives of this critical single market project.

Established in November 2019, the European Commission’s CMU High-Level Forum (HLF) brought together a diverse group of experts from different sectors tasked with the preparation of recommendations that were ambitious and game-changing, but also concrete and actionable. Its long-awaited report, published this week, identifies many of the measures that need to be taken forward.

Placing equity markets and retail investors at the heart of the CMU

A re-equitisation of Europe’s companies and financial landscape is one of the immediate priorities in the face of the Covid-19 crisis.

Public and private equity risk capital remain the most appropriate mechanisms to finance many businesses with high-growth potential, aiming to rapidly expand or to invest in frontier technologies. Supporting them is vital to the recovery. They represent riskier investments but are also likely to be the drivers of post-crisis growth and job creation. Well-functioning equity markets should also allow established corporates to strengthen their balance sheets in the face of a very sharp downturn in business activity.

The HLF Report puts forward a number of recommendations to bolster equity markets. These include adjustments to the prudential frameworks for banks and insurers to increase institutional investor capacity, the establishment of a European Single Access Point to improve access to company financial information across the EU, as well as targeted modifications of the prospectus, market abuse and MIFID/R regulatory frameworks to make public listing more attractive in particular to SMEs.

Some topics will require further assessment and discussion. For example, while promoting equity research coverage on SMEs is a very legitimate aim, creating a bespoke treatment for SMEs with exemptions from the MiFID II unbundling rules could lead to further regulatory complexity and other drawbacks.

Another central priority is the expansion of retail investor participation in EU capital markets. A large part of the wealth of European households continues to be placed in cash deposits with currently negative real returns. This must change if we are to unlock the true potential of the CMU. Increasing the supply of investable capital is one of the conditions to supporting businesses and mobilising investments to help mitigate the impact of climate change.

A further important recommendation in the HLF Report is to support the introduction of auto-enrolment systems to stimulate adequate pension coverage across all Member States. Experience in some jurisdictions suggests that auto-enrolment schemes can lead to very significant growth in pensions savings over a relatively short period of time, thereby increasing the pool of capital available for investment. The implementation of such schemes has the potential to be a true game-changer in several countries.

Revisiting past CMU initiatives – can they be successfully delivered this time?

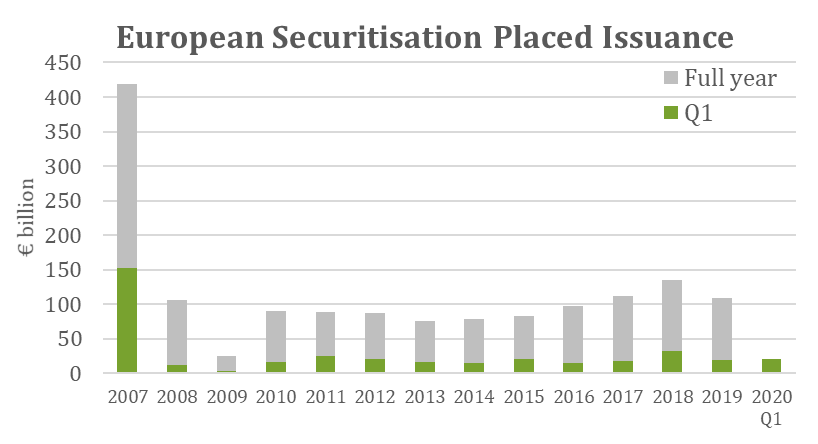

The framework for simple, transparent and standardised (STS) securitisation rightly constituted one of the building blocks of the initial CMU Action Plan. Yet the potential of the STS framework and the ambition to promote a safe and expanded European securitisation market are so far not being achieved. Over a decade on from the financial crisis, issuance in Europe is still at a fraction of the level it once was (figure below).This is in part due to an excessively complex regulatory framework and an overly conservative treatment of securitisation that continue to discourage a meaningful recovery of the European market.

The HLF Report provides a set of clearly defined recommendations in this area. It rightly concludes that a review of the securitisation rules should seek to simplify the process for significant risk transfer, adjust the prudential treatment of securitisation for banks and insurers, support the development of synthetic securitisation, reconsider the eligibility of securitisation under liquidity regulation and simplify disclosures.

These are the right measures. Policymakers must now prioritise the adjustments needed to ensure that Europe can benefit from well-functioning securitisation markets and the possibilities offered by the “best in class” STS label.

There is long history of European initiatives which have aimed to tackle instances of fragmentation in taxation regimes, insolvency procedures and legal definitions. Progress in these areas has been slow and challenging due to divergent national laws and legal systems. Yet such legal frameworks are fundamental in underpinning the functioning of capital markets and building a true CMU.

One can only hope that Member States will find the willingness to implement the HLF’s recommendations to overcome deep-seated inefficiencies and legal impediments to capital market integration. The introduction of a standardised system for relief at source of withholding tax should certainly be one of the priority actions to address a costly source of friction in intra-EU business.

The securities markets structure – inefficiencies need to be tackled

EU markets have shown resilience in the recent period of high stress and volatility, with financial firms and infrastructures continuing to fulfil their core functions without major systemic disruptions.

However, further work is needed to improve the effectiveness of the securities market structure, which is central to the future success of the CMU. Capital markets need cost-effective channels for the issuance, distribution and trading of securities for the benefit of investors and non-financial companies. They need well-calibrated transparency regimes that support liquidity and market confidence.

For this reason the upcoming reviews of the MiFID II/MiFIR framework should be pursued in alignment with the CMU objectives to strengthen the capacity of EU capital markets and enhance their efficiency and connectivity.

The priorities must include addressing – and removing – deep inefficiencies in Europe’s equity market structure. Chief among these are the share trading obligation and the double volume caps system, whose effects have not been positive for Europe’s markets. Another focus area should be tackling persistent problems regarding the high cost of market data, which is a fundamental concern to many market participants.

As regards post-trade market infrastructures, the HLF has regrettably missed an opportunity to recommend a review of the CSDR settlement discipline regime in order to remove the mandatory obligation on investors to execute buy-ins, despite putting forward targeted recommendations on other aspects of the CSDR.

This obligation, which is due to go live in February 2021, will restrict the ability of investors to manage their trading and settlement processes, risking damage to liquidity, greater costs and higher barriers to investing. It is unfortunate that the HLF was not able to reach a consensus on this point.

Conclusion

The importance of the CMU project has never been more obvious. The upcoming reviews of key legislations – MiFID/R, CSDR, Solvency 2, the Securitisation Regulation and the bank prudential framework, among others – must be pursued with ambition and a clear focus on the CMU’s aims to expand, integrate and make more efficient the EU’s markets.

The impact of the Covid-19 crisis should serve as a catalyst to overcome national differences and legislative discrepancies that have weakened past initiatives. As the EU navigates one of its greatest ever economic and social challenges, the hope is that all parties will see the vast potential of a fully-fledged CMU in aiding economic recovery and supporting sustainable growth.